All Categories

Featured

Table of Contents

Insurance policy companies will not pay a small. Rather, consider leaving the cash to an estate or trust fund. For more thorough info on life insurance policy get a duplicate of the NAIC Life Insurance Policy Customers Guide.

The IRS puts a limitation on exactly how much cash can go into life insurance premiums for the plan and exactly how promptly such premiums can be paid in order for the plan to retain all of its tax benefits. If specific limitations are surpassed, a MEC results. MEC policyholders might be subject to taxes on circulations on an income-first basis, that is, to the extent there is gain in their plans, as well as penalties on any type of taxable amount if they are not age 59 1/2 or older.

Please note that exceptional car loans accrue rate of interest. Income tax-free treatment additionally assumes the funding will eventually be satisfied from income tax-free survivor benefit profits. Car loans and withdrawals lower the plan's money worth and fatality benefit, might cause certain policy benefits or bikers to become not available and may increase the possibility the policy may lapse.

A client might certify for the life insurance coverage, but not the cyclist. A variable universal life insurance coverage agreement is an agreement with the primary function of providing a fatality benefit.

What happens if I don’t have Trust Planning?

These portfolios are very closely managed in order to satisfy stated investment objectives. There are fees and fees related to variable life insurance policy contracts, consisting of death and threat fees, a front-end lots, administrative costs, investment management costs, surrender charges and costs for optional bikers. Equitable Financial and its affiliates do not offer legal or tax obligation suggestions.

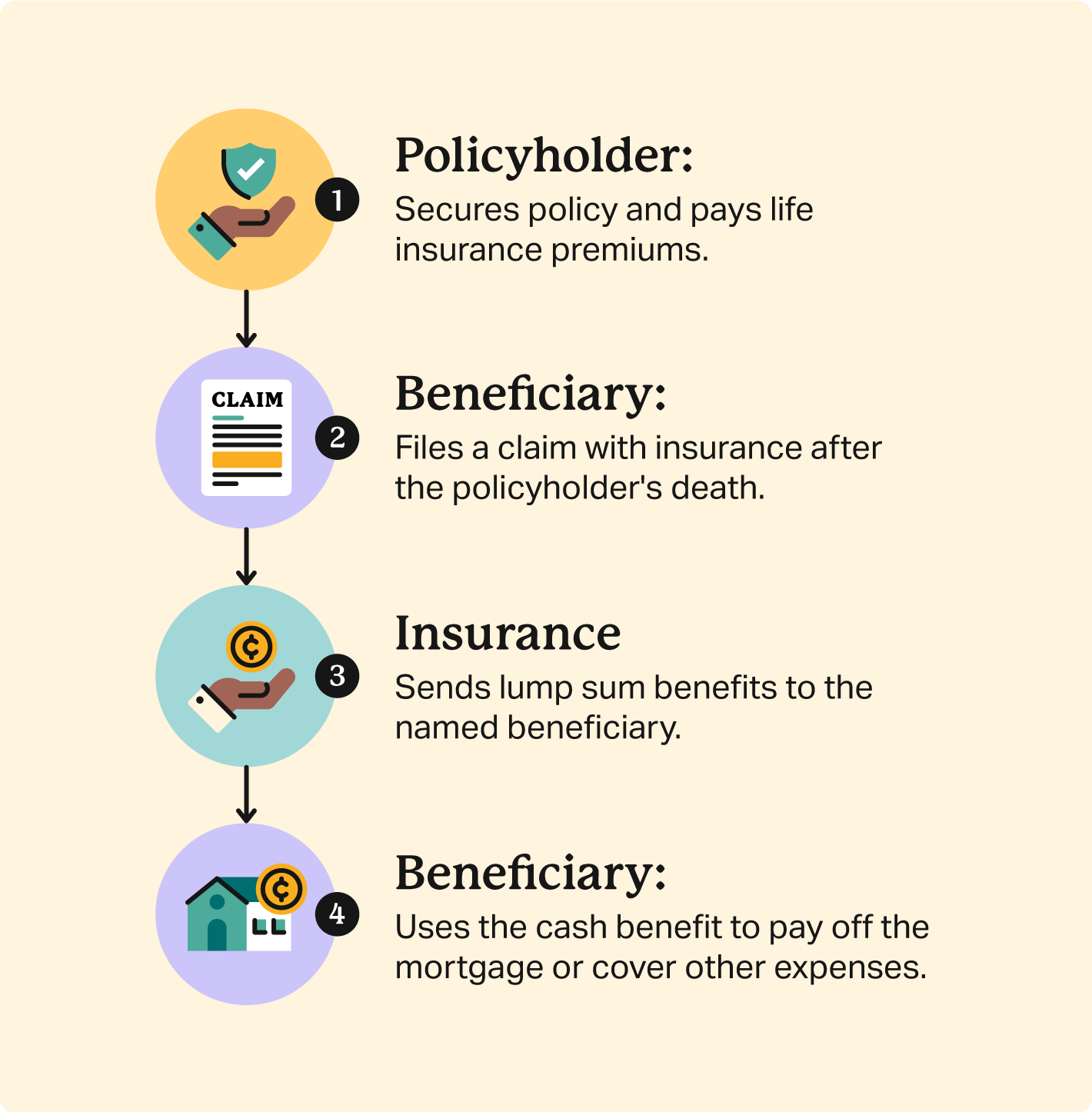

Whether you're beginning a family members or getting wedded, individuals typically start to consider life insurance policy when somebody else starts to rely on their ability to earn a revenue. Which's great, since that's specifically what the fatality advantage is for. As you find out much more regarding life insurance policy, you're likely to discover that many policies for circumstances, entire life insurance have much more than simply a survivor benefit.

What are the benefits of whole life insurance? Right here are several of the crucial things you should know. Among the most attractive benefits of acquiring an entire life insurance policy policy is this: As long as you pay your premiums, your survivor benefit will never end. It is guaranteed to be paid despite when you pass away, whether that's tomorrow, in five years, 80 years or perhaps further away. Long term care.

Believe you do not require life insurance coverage if you do not have youngsters? There are several advantages to having life insurance policy, even if you're not supporting a family members.

What is a simple explanation of Beneficiaries?

Funeral expenditures, burial expenses and medical expenses can add up. Irreversible life insurance is offered in numerous amounts, so you can select a death benefit that satisfies your demands.

Determine whether term or permanent life insurance is right for you. As your personal circumstances adjustment (i.e., marital relationship, birth of a youngster or work promo), so will certainly your life insurance needs.

Essentially, there are two kinds of life insurance policy plans - either term or permanent plans or some mix of both. Life insurance companies offer numerous kinds of term plans and typical life policies in addition to "rate of interest sensitive" items which have become more common since the 1980's.

Term insurance gives defense for a given amount of time. This duration can be as short as one year or offer protection for a certain number of years such as 5, 10, twenty years or to a specified age such as 80 or sometimes as much as the earliest age in the life insurance policy mortality.

Retirement Planning

Presently term insurance coverage rates are extremely competitive and among the most affordable historically experienced. It should be kept in mind that it is a widely held belief that term insurance policy is the least pricey pure life insurance protection available. One requires to review the policy terms carefully to make a decision which term life options appropriate to satisfy your certain situations.

With each new term the premium is raised. The right to renew the policy without proof of insurability is a crucial advantage to you. Or else, the danger you take is that your health might weaken and you might be incapable to acquire a plan at the exact same prices or even at all, leaving you and your recipients without coverage.

The size of the conversion duration will differ depending on the type of term policy acquired. The costs price you pay on conversion is normally based on your "present obtained age", which is your age on the conversion day.

Under a degree term policy the face amount of the policy stays the same for the entire duration. Typically such plans are sold as home mortgage defense with the amount of insurance coverage decreasing as the equilibrium of the home loan decreases.

Why should I have Riders?

Traditionally, insurers have not can change premiums after the plan is sold. Since such plans might continue for several years, insurance firms must utilize traditional death, rate of interest and cost rate price quotes in the costs calculation. Flexible costs insurance, nevertheless, enables insurance providers to provide insurance policy at lower "present" premiums based upon much less conventional assumptions with the right to transform these costs in the future.

While term insurance policy is designed to provide protection for a defined amount of time, long-term insurance coverage is developed to give protection for your whole life time. To keep the premium price degree, the costs at the younger ages surpasses the actual price of defense. This additional costs constructs a reserve (cash worth) which assists spend for the policy in later years as the expense of security surges over the premium.

Under some policies, premiums are needed to be spent for an established number of years. Under other policies, costs are paid throughout the policyholder's life time. The insurance provider spends the excess premium bucks This sort of policy, which is occasionally called money value life insurance policy, creates a cost savings component. Money worths are crucial to a long-term life insurance policy plan.

Latest Posts

Final Expense For Senior

Final Expense Life Insurance Companies

Term Life Insurance Instant Quote