All Categories

Featured

Table of Contents

This is no matter whether the guaranteed person passes away on the day the policy begins or the day prior to the plan ends. Simply put, the quantity of cover is 'degree'. Legal & General Life Insurance Policy is an instance of a level term life insurance policy. A degree term life insurance policy plan can fit a variety of scenarios and requirements.

Your life insurance policy plan can additionally form component of your estate, so can be subject to Inheritance Tax learnt more concerning life insurance policy and tax obligation - Term life insurance for couples. Let's look at some attributes of Life insurance policy from Legal & General: Minimum age 18 Optimum age 77 (Life Insurance), or 67 (with Essential Health Problem Cover)

What life insurance coverage could you think about if not level term? Lowering Life Insurance can aid protect a payment home mortgage. The amount you pay remains the very same, however the degree of cover reduces about in line with the method a repayment home loan decreases. Decreasing life insurance policy can aid your enjoyed ones stay in the household home and stay clear of any additional disruption if you were to die.

If you pick level term life insurance, you can spending plan for your costs since they'll stay the very same throughout your term. Plus, you'll recognize specifically just how much of a fatality advantage your recipients will get if you pass away, as this amount won't change either. The rates for degree term life insurance policy will certainly depend upon numerous elements, like your age, health and wellness condition, and the insurance provider you select.

Once you undergo the application and medical examination, the life insurance firm will assess your application. They must educate you of whether you've been accepted soon after you use. Upon approval, you can pay your initial costs and sign any appropriate paperwork to guarantee you're covered. From there, you'll pay your costs on a month-to-month or annual basis.

An Introduction to Short Term Life Insurance

Aflac's term life insurance policy is hassle-free. You can pick a 10, 20, or three decades term and appreciate the added satisfaction you are worthy of. Dealing with an agent can assist you locate a plan that functions ideal for your needs. Find out more and get a quote today!.

As you look for ways to secure your financial future, you have actually likely encountered a wide array of life insurance coverage options. Picking the right insurance coverage is a large decision. You want to discover something that will help sustain your loved ones or the reasons essential to you if something happens to you.

Everything You Need to Know About What Does Level Term Life Insurance Mean

Many individuals lean towards term life insurance policy for its simpleness and cost-effectiveness. Term insurance coverage contracts are for a relatively short, specified amount of time yet have choices you can customize to your demands. Certain benefit alternatives can make your costs change over time. Level term insurance, however, is a sort of term life insurance policy that has consistent payments and an unvarying.

Level term life insurance coverage is a subset of It's called "degree" due to the fact that your premiums and the advantage to be paid to your liked ones continue to be the same throughout the contract. You won't see any type of modifications in price or be left questioning its value. Some agreements, such as each year sustainable term, might be structured with costs that raise with time as the insured ages.

They're figured out at the beginning and remain the same. Having constant settlements can aid you much better plan and budget plan due to the fact that they'll never ever alter. Dealt with fatality advantage. This is also evaluated the start, so you can know specifically what fatality advantage amount your can expect when you pass away, as long as you're covered and updated on costs.

You agree to a set costs and death benefit for the period of the term. If you pass away while covered, your death benefit will certainly be paid out to loved ones (as long as your premiums are up to day).

What Is Term Life Insurance For Spouse? A Complete Guide

You may have the choice to for another term or, more likely, restore it year to year. If your agreement has actually an assured renewability stipulation, you may not require to have a new medical test to keep your coverage going. Your costs are likely to raise due to the fact that they'll be based on your age at renewal time.

With this choice, you can that will certainly last the remainder of your life. In this case, once again, you might not require to have any kind of brand-new medical examinations, however costs likely will rise due to your age and brand-new coverage (Level term vs decreasing term life insurance). Various business offer numerous alternatives for conversion, make sure to understand your selections before taking this action

Consulting with an economic consultant also might help you establish the path that straightens best with your overall method. The majority of term life insurance policy is level term throughout of the agreement duration, however not all. Some term insurance coverage might come with a costs that increases over time. With decreasing term life insurance, your survivor benefit drops over time (this kind is often secured to especially cover a long-term financial obligation you're paying off).

And if you're established up for eco-friendly term life, then your costs likely will increase yearly. If you're checking out term life insurance policy and desire to ensure simple and foreseeable financial protection for your household, degree term might be something to take into consideration. Nonetheless, similar to any kind of kind of protection, it might have some limitations that do not meet your needs.

What is Term Life Insurance With Accidental Death Benefit? Quick Overview

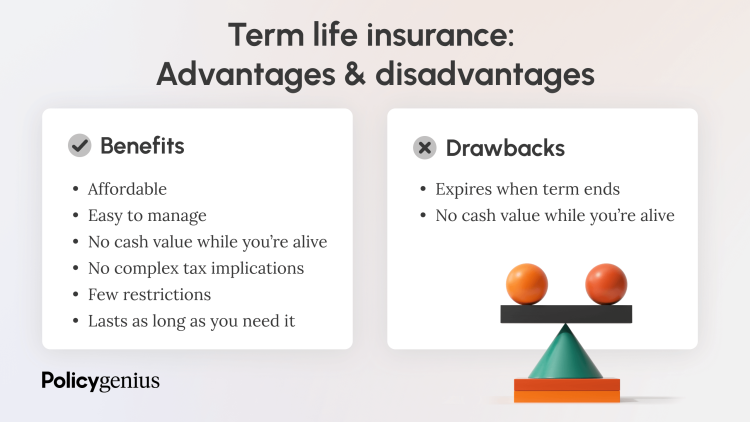

Commonly, term life insurance is a lot more affordable than long-term coverage, so it's an economical way to secure financial defense. Versatility. At the end of your agreement's term, you have numerous alternatives to proceed or carry on from coverage, commonly without needing a clinical test. If your budget or insurance coverage needs adjustment, death benefits can be decreased in time and outcome in a reduced costs.

As with other type of term life insurance policy, as soon as the contract finishes, you'll likely pay higher costs for insurance coverage since it will recalculate at your present age and health and wellness. Taken care of coverage. Level term offers predictability. Nevertheless, if your financial scenario modifications, you may not have the necessary insurance coverage and could need to purchase additional insurance.

But that doesn't indicate it's a suitable for everybody (Joint term life insurance). As you're purchasing life insurance coverage, right here are a few vital factors to consider: Budget. Among the advantages of level term protection is you recognize the expense and the survivor benefit upfront, making it less complicated to without stressing over increases in time

Age and health and wellness. Usually, with life insurance policy, the healthier and more youthful you are, the more cost effective the coverage. If you're young and healthy and balanced, it may be an attractive option to secure low costs currently. Financial obligation. Your dependents and financial obligation play a role in establishing your coverage. If you have a young family, for circumstances, degree term can assist give financial backing throughout crucial years without spending for protection much longer than required.

Latest Posts

Final Expense For Senior

Final Expense Life Insurance Companies

Term Life Insurance Instant Quote