All Categories

Featured

Table of Contents

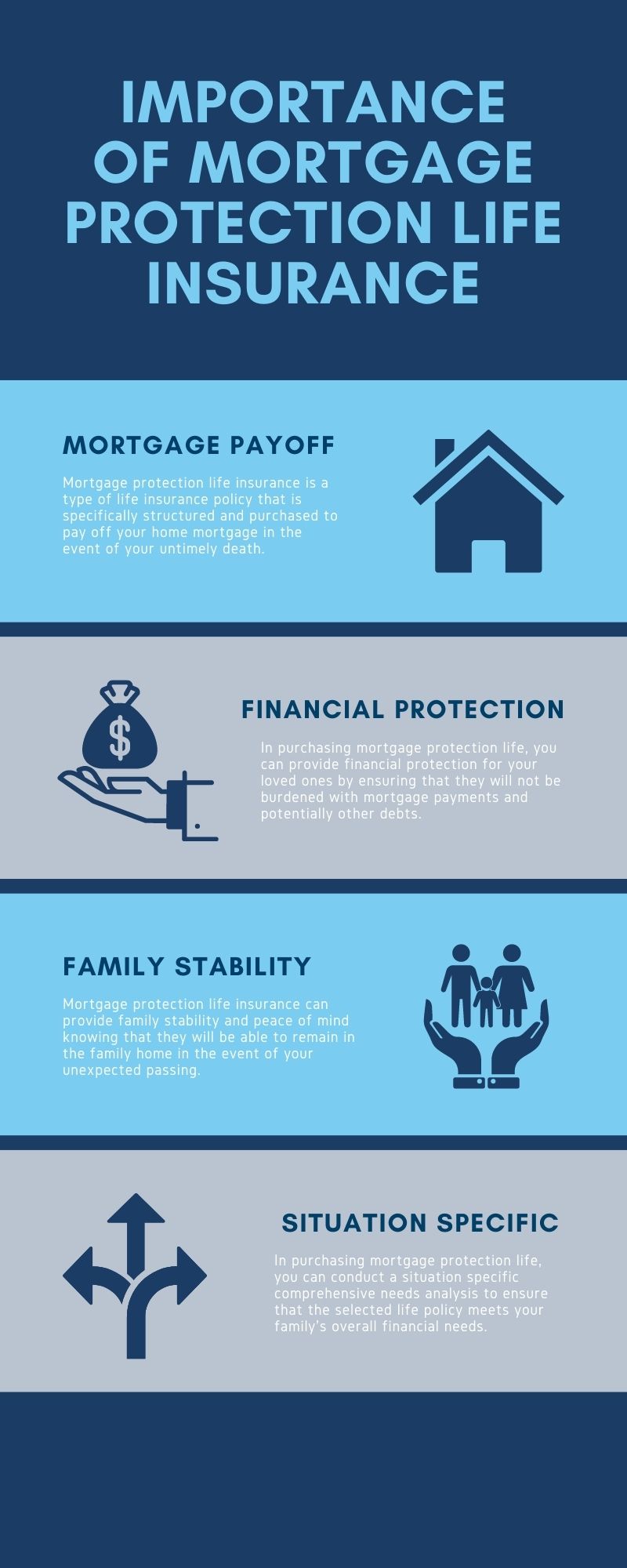

This policy tightly lines up with your home mortgage. Actually, when individuals claim "home mortgage protection life insurance coverage" they tend to indicate this. With this plan, your cover amount decreases in time to reflect the shrinking amount total amount you owe on your home loan. You could begin your plan covered for 250,000, however by year 10 your plan could cover 150,000, since that's what your home loan is after that worth.

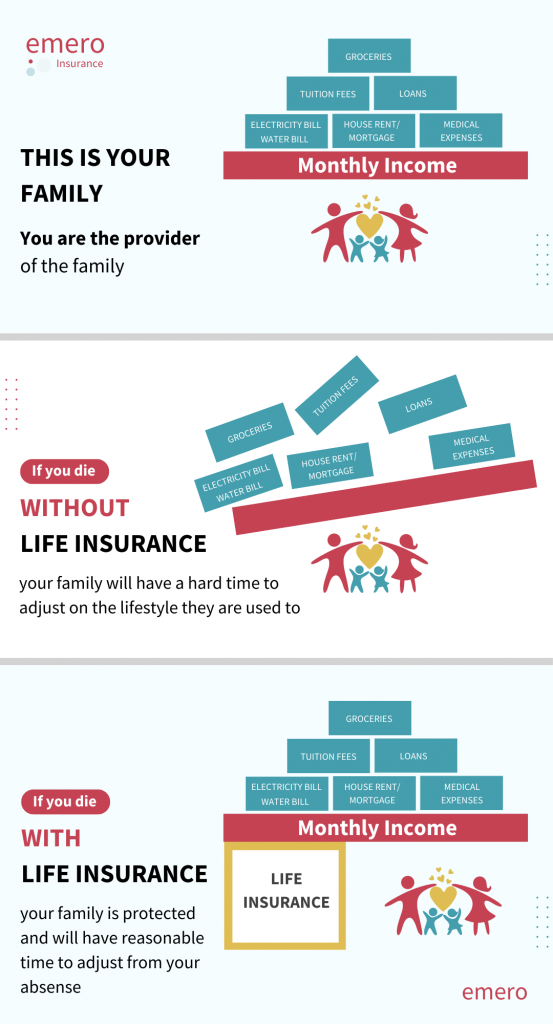

The factor of home mortgage protection is to cover the expense of your mortgage if you're not about to pay it.

You can relax simple that if something happens to you your home mortgage will certainly be paid. Life insurance coverage and home mortgage defense can be practically one in the exact same.

The lump sum payout goes to your enjoyed ones, and they might pick not to get rid of the home loan with it. It depends if you still desire to leave cash for liked ones when you pass away. If your mortgage is clear, you're mainly debt-free, and have no economic dependents, life insurance coverage or illness cover may feel unnecessary.

If you're home loan free, and heading right into retirement age area, it's worth looking getting recommendations. Important health problem cover can be pertinent, as can over 50s cover. It depends on the worth of your mortgage, your age, your wellness, family dimension, way of life, hobbies and circumstances as a whole. While there are a lot of variables to be exact in answering this question, you can find some generic examples on our life insurance coverage and home mortgage protection pages - mortgage disability insurance which plan is best.

Whether you wish to go it alone, or you plan to obtain suggestions at some factor, below's a tool to aid you with points to think regarding and just how much cover you might require. Life insurance coverage exists to secure you. And no 2 individuals are the exact same. The very best policy for you relies on where you are, what's taking place in your home, your wellness, your plans, your requirements and your budget.

What Is Mortgage Insurance Based On

This means that every one of the staying home loan at the time of the fatality can be totally paid off. The affordable results from the payout and liability to the insurance provider decreasing gradually (mpi insurance providers). In the early years, when the fatality payout would certainly be highest possible, you are generally healthier and much less most likely to die

The advantages are paid by the insurer to either the estate or to the recipients of the individual that has actually passed away. The 'estate' is everything they possessed and leave when they die. The 'recipients' are those qualified to a person's estate, whether a Will has actually been left or otherwise.

They can after that continue to reside in the home without any additional mortgage payments. Plans can additionally be arranged in joint names and would certainly then pay on the initial fatality during the mortgage term. The advantage would certainly go right to the enduring companion, not the estate of the deceased individual.

Home Protection Insurance Plan

The plan would certainly after that pay the sum guaranteed upon diagnosis of the strategy owner suffering a major illness. These consist of cardiovascular disease, cancer cells, a stroke, kidney failure, heart bypass surgery, coma, overall long-term special needs and a variety of various other significant conditions. Monthly premiums are usually repaired from beginning for the life of the plan.

The premiums can be affected by poor health and wellness, way of living variables (e.g. smoking or being obese) and occupation or leisure activities. The rate of interest to be charged on the mortgage is additionally crucial. The strategies typically ensure to settle the outstanding quantity as long as a specific rate of interest is not gone beyond during the life of the lending.

Home mortgage protection plans can supply straightforward security in case of early fatality or crucial ailment for the exceptional mortgage quantity. This is generally lots of people's biggest month-to-month monetary cost (how much does mpi cost). They need to not be taken into consideration as ample security for all of your situations, and other kinds of cover may likewise be needed.

We will assess your insurance requires as part of the home mortgage recommendations procedure. We can then make recommendations to fulfill your needs and your allocate life cover.

Purchase a term life insurance policy plan for at the very least the amount of your mortgage. If you pass away throughout the "term" when the plan's in pressure, your enjoyed ones get the face value of the plan. They can utilize the profits to pay off the home mortgage. Profits that are commonly tax obligation complimentary.

Mortgage Paid In Full Upon Death

If your home loan has a low rate of interest rate, they might desire to pay off high-interest credit score card financial debt and maintain the lower-interest home mortgage. Or they might want to pay for home maintenance and maintenance.

Figure out other ways that life insurance policy can assist safeguard your and your household.

The inexpensive month-to-month costs will certainly never ever boost for any kind of reason. For every year the Policy continues to be continuously in pressure, primary insured's Principal Advantage will immediately be enhanced by 5% of the First Principal Advantage up until the Principal Advantage is equal to 125% of the First Principal Benefit, or the key insured turns age 70, whichever is previously.

Mortgage Insurance Payout

Most individuals at some point in their lives battle with their finances. In today's economy, it's more typical than ever. "Just how secure is my home?" It's a concern several of us don't believe to ask until after a crash has already taken place. Globe Life is ranked A (Exceptional)**by A.M.

For most individuals, term life insurance policy offers much more durable protection than MPI and can additionally be used to pay off your home loan in the event of your death. Home mortgage life insurance is created to cover the equilibrium on your home mortgage if you pass away before paying it in complete. The payment from the plan decreases in time as your home mortgage equilibrium drops.

The death benefit from an MPI goes straight to your home loan lender, not your family, so they wouldn't be able to use the payout for any kind of other financial debts or costs. A normal term life insurance coverage. life insurance on mortgage plan permits you to cover your home mortgage, plus any various other expenditures. There are cheaper alternatives offered.

Mortgage Life Companies

The survivor benefit: Your MPI survivor benefit lowers as you settle your home mortgage, while term life policies most commonly have a level survivor benefit. This means that the insurance coverage amount of term life insurance policy remains the exact same for the entire duration policy. Home mortgage security insurance policy is often perplexed with personal home mortgage insurance coverage (PMI).

Nonetheless, whole life is considerably much more costly than term life. "Term life is super vital for any type of specific they can have college finances, they may be married and have youngsters, they may be solitary and have charge card lendings," Ruiz said. "Term life insurance coverage makes good sense for the majority of people, however some people want both" term life and entire life protection.

Otherwise, a term life insurance policy policy likely will provide more flexibility at a less expensive expense."There are people who do both [MPI and term life] since they desire to make sure that their home mortgage obtains paid off. It can likewise depend upon who the beneficiaries are," Ruiz stated." [It's ultimately] up to what sort of protection and exactly how much [insurance coverage] you want - credit life mortgage insurance."If you're uncertain which kind of life insurance policy is best for your circumstance, speaking to an independent broker can assist.

The only standard "exemption" is for self-destruction within the initial 13 months of establishing up the policy. Like life insurance, mortgage protection is pretty uncomplicated.

Latest Posts

Final Expense For Senior

Final Expense Life Insurance Companies

Term Life Insurance Instant Quote